Rising Home Insurance Premiums Due to Increased Climate Risks

The landscape of homeowners insurance in the United States is undergoing a significant transformation. With climate-related natural disasters on the rise, many homeowners find themselves facing soaring premiums that threaten their financial stability. According to a comprehensive Treasury Department report, the increasing frequency and intensity of natural disasters are directly impacting insurance costs, particularly in high-risk areas. This transformation raises critical questions about the future of home insurance and its accessibility for American families.

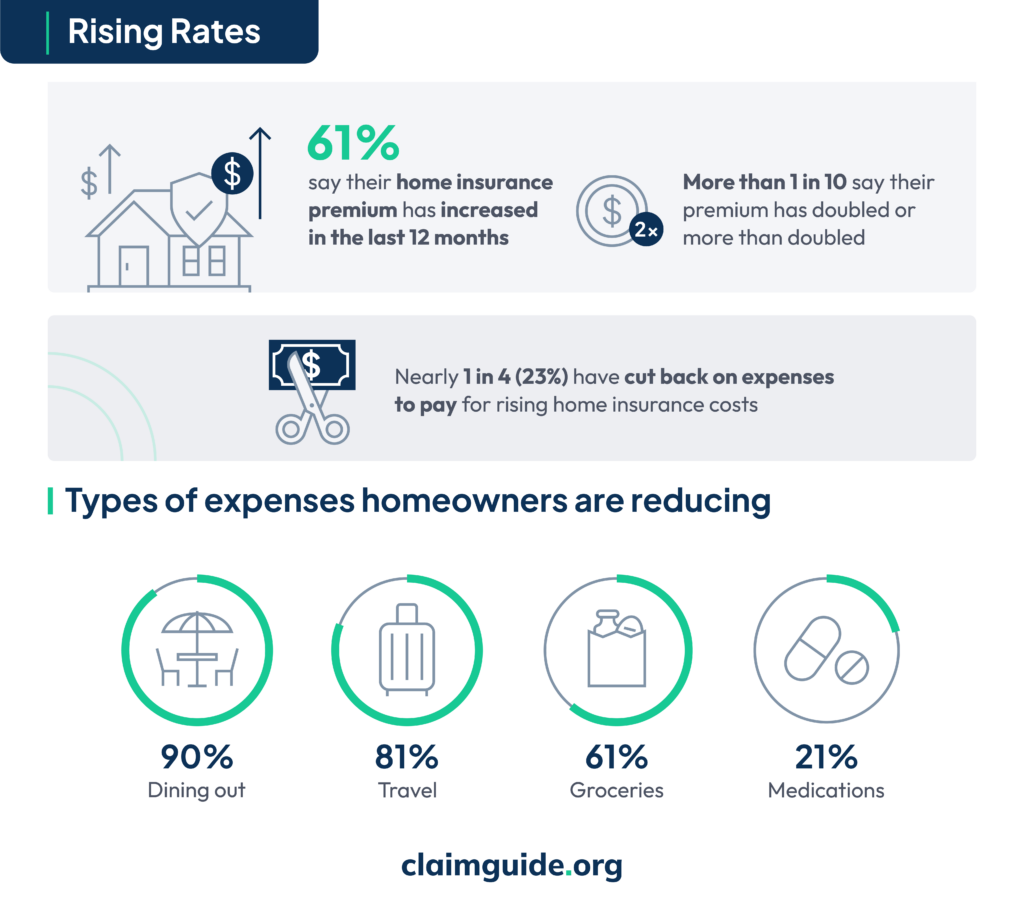

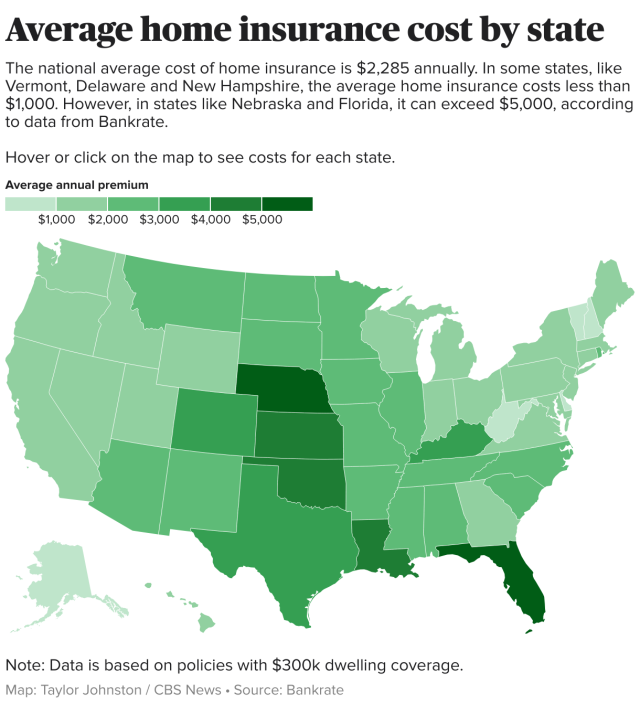

The report indicates a troubling trend: costs for insurance policies are climbing at a rate significantly higher than inflation, particularly in regions most affected by climate risks. Homeowners living in areas deemed high-risk are seeing their premiums rise faster and higher than those in more secure regions. In fact, for many, this could mean the difference between maintaining coverage or potentially facing gaps in protection at a time when disasters are becoming more frequent.

The Impact of Climate Change on Insurance Premiums

Understanding the Rising Costs

To put it plainly, climate change is not just an environmental issue; it’s becoming a pressing financial one too. The Treasury Department’s extensive analysis covering 2018 to 2022 highlighted a staggering reality: premiums in the most vulnerable areas skyrocketed. On average, homeowners in the top 20% of high-risk zip codes paid 82% more than those in safer areas. This alarming statistic underscores the financial strain put on consumers just trying to protect their homes.

Further analysis revealed that the frequency and severity of natural disasters, from wildfires to hurricanes, correlate highly with increased insurance costs. During the study period, climate-related events resulted in more than 84 disasters each with damages exceeding $1 billion, culminating in a staggering total of $609 billion. As disasters become costlier, insurers are forced to adjust their policies to maintain viability, thereby raising premiums across the board.

Challenges for Homeowners

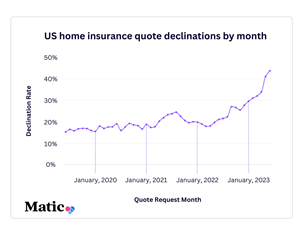

It’s not just the premiums that are rising; accessibility to insurance is declining as well. Many homeowners, especially those living in at-risk areas, are finding it more challenging to secure coverage. The non-renewal rates in high-risk regions are alarmingly high, approximately 80% more than those in less-risky locales. This means that families are not only facing higher costs but also the possibility of losing their coverage altogether when they need it most.

Moreover, average claims in higher-risk areas are about $24,000 compared to $19,000 in lower-risk regions, indicating a need for insurers to manage risk even more conservatively. Given that 2023 has already seen a record number of claims, the insurance sector is on the brink of a major operational and financial crisis.

The Response from Insurers and Government

Insurers Adjusting Their Policies

Insurance companies are not sitting idle amidst these challenges; they are forced to adapt. Concerns over sustainability and profitability mean that insurers are re-evaluating their risk assessment models and adjusting their coverage options accordingly. This shift is reflected in their reluctance to provide coverage in areas frequenting severe weather patterns.

As insurers adopt stricter criteria, consumers seeking insurance in these regions are often met with steep premiums and limited options. The Treasury report underlined this trend, advocating for more innovative solutions to address the insurance dilemma exacerbated by climate extremes. Insurers face the tough challenge of balancing profitability while ensuring that coverage remains accessible to all homeowners.

Government Initiatives

In response to the growing crisis, governmental bodies recognize the need for intervention. The Treasury Department’s report calls for a comprehensive review of insurance policies as well as additional support to lessen the burden on homeowners. This could include regulatory changes aimed at promoting competition among insurers and encouraging the inclusion of innovative insurance offerings targeting climate-resistant homes.

Furthermore, public awareness campaigns can play a vital role in educating homeowners about available resources, helping them understand their options and fostering resilience to climate-related threats. As the government contemplates the future of homeowners insurance, proactive measures will be necessary to stave off economic repercussions and protect citizens.

Consumer Reactions and Adaptations

Homeowner Strategies

Faced with rising premiums and limited options, many homeowners are adopting new strategies to mitigate the impact of increasing costs. Some are turning towards comprehensive insurance policies that offer broader protections against various climate-related incidents, such as floods and wildfires. Others are investing in home improvements aimed at increasing property resilience, making their homes less vulnerable to climate risks.

Moreover, a growing number of homeowners are seeking advice from insurance experts to navigate this complex landscape. They are becoming more adept at shopping around and comparing prices, ensuring that they are not paying more than necessary for their coverage. This shift in consumer behavior indicates an increasing awareness of market dynamics and a desire to find the best protection possible amidst rising costs.

Communities Taking Action

In addition to individual efforts, communities are banding together to address the issue collectively. Local initiatives are focusing on resilience-building, promoting sustainable practices, and advocating for better policy regulations at the state level. For instance, neighborhood associations might offer shared resources or create programs aimed at improving community-wide infrastructure to lessen the risk of natural disasters.

Ultimately, these collaborative efforts can have substantial impacts. By working together, communities can foster intentions on climate preparedness, potentially paving the way for better insurance options and creating a unified front against rising premiums.

Future Outlook: What Lies Ahead?

Anticipated Trends

The predictive models suggest that without significant interventions, homeowners should anticipate continued increases in insurance premiums for the foreseeable future. The key drivers will remain the frequency of climate-related disasters and the corresponding economic toll inflicted on communities. Adjustments within the insurance market will increasingly hinge on adapting to climate realities while balancing financial sustainability.

Moreover, as more data becomes available regarding climate risks, we can expect insurers to evolve their models further in ways that could result in even greater disparities between coverage in high-risk versus lower-risk areas. Without proactive efforts from both insurers and government agencies, this problem could escalate into a larger crisis.

A Call to Action

As climate change continues to reshape our environmental landscape, it is increasingly crucial for stakeholders at all levels to come together and devise effective solutions. This will necessitate collaborative efforts among homeowners, insurers, and policymakers to create a more resilient framework for homeowners insurance. By addressing the systemic issues driving up costs, we can work towards a future where insurance remains accessible and affordable for all, regardless of location.

In conclusion, the landscape of homeowners insurance is changing, and those discrepancies serve as an urgent reminder of the broader implications of climate change on everyday lives. By fostering conversations around resilience, taking actions that prioritize sustainable practices, and advocating for equitable policies, we can pave the way forward amidst these challenges.

I’m Mikael, a 35-year-old Gossip Gravity Creator. I’m passionate about curating captivating content that sparks conversations and ignites curiosity. Join me on this exciting journey as we explore the fascinating world of gossip and trends together!